I recently read the book 100 baggers: Stocks that return 100-To-1 and How to find them by Christopher Mayer. I thought of writing a review and write summary of learning from the book for the benefit of fellow investors.

The three basic questions which every investor who wants to make 100 Bagger returns are: WHAT to buy? WHEN to buy? HOW to hold/sell?

Very simple steps to have 100 baggers in the portfolio:

- Finding great business at reasonable valuation

- Holding them for long period of time

According to Thomas Phelps’s book 100 to 1 in the stock Market, to make money in stocks one must have – “The vision to see them, the courage to buy them and the patience to hold them.”

Key areas to focus while identifying great businesses that can turn into 100 baggers based on patterns identified from past 100 baggers:

- Business must be providing solution

- Must have an enduring moat or competitive advantage

- Excellent capital allocation strategy

- Long runway

- Earnings Power

- Ability to re-invest capital at high return on capital

- Company run by owners operator with skin in the game

What to look for:

“Every human problem is an investment opportunity if you can anticipate the solution”.

Companies that have new methods, new materials and new products – basically things that improve life, that solve problems and allow us to do things better, faster and cheaper.

Study markets and invest in long term enterprises which have the potential to vastly outpace other companies and industries and stick with them as long as the theme is intact. So lesson is one needs to stick to the original theme and if it is intact just hold on.

Intuitive formula for 100 baggers:

Earnings Growth + PE Re-rating = Multi-Bagger

Key factors for Earnings Growth:

(a) Sales Growth

(b) Operating Leverage

(c) Margin Expansion

(d) Debt Reduction

The fastest multi-bagger returns come during the combination of all the above factors.

(a) Sales Growth generally comes from gaining market share in the existing markets, expanding into new markets and creating new products

(b) Operating Leverage comes into play when businesses have high fixed cost which gets advantage of economies of scale, network effect and bargaining power to lower costs

(c) Margin Expansion happens from reduced cost, improved efficiency, pricing power and sticky products

(d) Debt reduction due to cash flow generation reduces finance cost and further improves earnings

Thus, single most important factor is GROWTH in all the dimensions – sales, margin and valuation.

Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity and correspondingly stronger returns on invested capital.

Identifying great businesses with enduring moat:

“A truly great business must have an enduring “moat” that protects excellent returns on invested capital” – Warren Buffett

In his The Little Book That Builds Wealth, Dorsey uses an analogy for why you should pay attention to moats: “It’s common sense to pay more for something that is more durable. From kitchen appliances to cars to houses, items that last longer are typically able to command higher prices…The same concept applies in the stock market.”

Some very common forms of Moats are:

- Strong Brand

- High switching costs

- Network effects

- Low cost advantage

- Economies of Scale

- Patents and IP

Moats, in essence, are a way for companies to fight mean reversion, which is like a strong current in markets that pulls everything toward average.

Measuring the Moat and Indicators

Michael Mauboussin has done some good work on Measuring the Moat. He suggested interesting mental model to find Moat in the sector value chain using industry map.

This details all the players that touch an industry. For airlines this would include aircraft lessors (such as Air Lease), manufacturers (Boeing), parts suppliers (B/E Aerospace) and more. What he aims to do is show where the profit in an industry winds up. These profit pools can guide you on where you might focus our energies. For example, aircraft lessors make good returns; travel agents and freight forwarders make even-better returns.

Some indicators of companies in value-chain having Moats:

- Track record to earn a high return on invested capital

- High gross and operating margins for long period of time

Gross margin is a good indication of the price people are willing to pay relative to the input costs required to provide the good. It’s a measure of value added for the customer.

Earnings Power and not Earnings:

One common trap is that earnings has many limitations. One has to also look for long terms earnings which can be produced by intangible growth-producing initiatives such as R&D, promo/advertising and employee education. These are expensed but benefits will be coming for long term.

Earnings power reflects the ability of the stock to earn above-average rates of return on capital at above-average growth rates. It’s essentially a longer-term assessment of competitive strengths.

A company can report a fall in earnings, but its longer-term earnings power could be unaffected. In the same way, earnings may rise but the underlying earnings power may be weakening.

Capital allocation:

Saurabh Mukherjea talks about many Indian businesses which turned multi-baggers in his book “The Unusual Billionares”. Efficient Capital Allocation is one of the most common and important characteristics of all great businesses that became multi-baggers.

Promoters/CEOs have five basic options to allocate capital:

- Invest in existing operations

- Acquire other businesses

- Pay dividends

- Pay down debt

- Buyback stock

here are three basic ways to raise money:

- Issue stock

- Issue debt

- Use the cash flow of the business

This forms the collective toolkit for capital allocation decision which if used wisely can generate excellent results for the company.

- Capital allocation is the CEO’s most important job

- Value per share is what counts, not overall size or growth

- Cash flow, not earnings, determines value

Long run-way:

We need to understand that value of a business is the sum of its future cash flows, discounted back to present. Hence, focusing on long run-way of business unaffected by disruption (or ones which can evolve) and having long term view is extremely important.

Return on Capital

This is one of the most important parameter. If a company can continue to reinvest at high rates of return over long periods of time, the stock and earnings keep compounding which gives parabolic effect.

“If a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result” – Charlie Munger

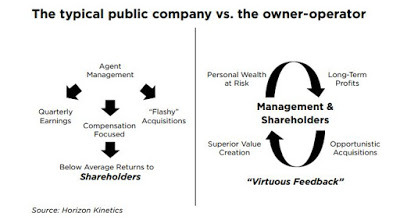

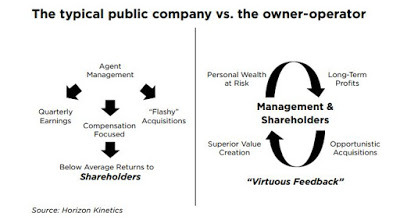

Company run by Owner-Operators:

Owner-Operators have skin in the game and an efficient capital allocation as owner can create miracles for the company.

Also, it is easier to hold onto a stock through the rough patches knowing that we have a talented owner-operator with skin in the game at the helm.

Holding great business for long period of time requires investors to build resilient psychology.

Psychological Factors

Boredom Arbitrage – having truly long term view of business:

Investors crave activity and stock markets are built on it. The media feeds it all, making it seem as if important things happen every day. This results in churning of portfolio in very short time period.

The ecosystem doesn’t want you to sit tight, they want to charge you fees, brokerage and sell you stuff. The greatest fortunes however come from gritting your teeth and holding on.

Most investors have been conditioned to measure stock price performance based on quarterly earnings but not on business performance. Investors can think in terms of years and invest in stock which are cheap today because others can’t look beyond few quarters.

Once we identify great businesses which can compound over long period of time, then only task left is SIT TIGHT. It takes longs than 3,5 or even 10 years to get 100-fold returns. And holding onto stocks beyond that period requires PATIENCE.

As Philip Fisher puts in his book Common Stock and Uncommon Profits “If the job has been correctly done when a common stock is purchased, the time to sell it is—almost never.”

This is the path of true wealth creation through stock market investing..!!

Disclaimer: The article is for knowledge sharing purpose. This should not be considered as an investment advice in any manner. Please consult your financial adviser for any investing decisions.

Note: All books hyperlinks will redirect you to it’s amazon page

Brilliant piece.

Brilliant article. Patience is the key to gain a healthy return on investment in stock market .

Factors governing Entry level and Exist level requires a lot to discuss.

I understand importance of moat .Thank

sir, very nice article as always. giving new sight to look at & value any business ( & not stock)

—- Mr. sane v. k. ( vikasent09@gmail.com)

Great insight……think about past record, competitive advantage, corporate governance and mangement

Simple,neat explanation for beginner

VERY NICE

Very concise and informative.

BY & LARGE a retail investor has very narrow band of resources for getting information about any company( especially its promotors ) & is main reason why he falls short to make a good decision at early stages of any business. Please guide on this issue.

Nice article to start with. Gives warm entry in world of equities.

Long term is the best way to earn money from stock market.

Excellent study material throwing light on identifying multibaggers. Will definitely be of help to those who are in search of the same.

Thanks for this kind of knowledge.

Hi sir,

I am really thankful of you for such a nice explanation on 100x stocks. Above have been very useful insights & never saw before. The given parameters for identification are really excellent. My only concern will be whether such criteria can be completed within a year period.

Thanks again,

Try to hunt such stocks from Indian bourses.

Regards,

CK Talreja

Very informative. Thanks.

Loved it as the information in very simple language.

Nice article, one needs to be a sound business analyst. The important aspect is to understand the business model, to dig deep to understand reasons that why and how the business can become big or earnings can become multi fold over a period of time….

Great article, Thanks for the informative knowledge..

good article

awesome presentation

Really wonderful explanation of hidden wisdom in easy way

Fabulous article

well explain sir

REALLY WONDERFUL , IF APPLIED THIS PRINCIPLES THEN LIFE WILL BE BEAUTIFUL

Good read… insightful sir.

Excellent explaination sir

Excellent Article Vivek. Insightful

Thank-you Sir….for this type of knowledge..💕

Great insight into the basics

The article is good…However, to make it more interesting kindly add examples of companies and pictures to illustrate even better of the following pointers:

Business must be providing solution

Must have an enduring moat or competitive advantage

Excellent capital allocation strategy

Long runway

Earnings Power

Ability to re-invest capital at high return on capital

Company run by owners operator with skin in the game

Thank you very much for educating and helping in the journey of the common man towards financial freedom

Excellent and good article which is very useful for retail investor.

….. excellent….keep up sir.

Once again the only stock which comes to my mind is SUVEN LIFE SCIENCE with its R&D in Alzheimer Disease.

USA has 6.2 million people suffering from Alzheimer Disease.

INDIA has 4 million people suffering from Alzheimer Disease. But in INDIA as we do not have educated people I believe this as a disease is also not recognized.

No other pharma companies have done any research except for SUVEN LIFE SCIENCE. It seems in the world 1 out of 9 people suffer from this disease.

Ultimately this Company is the best example of MOAT.

NO COMPETITION – even internationally.

It will be bought over by a BIG PHARMA COMPANY ultimately

This is one of the company to look into further but there is lot of competition in this race. Actually I am invested ( as seed investor) in one of the company ( Not public yet ).

Will be interesting to dig deeper into this space. FDA has recently approved IV infusion for treatment of AD.

Excellent sir, you have explained moat in a wonderful manner. Thanks for great initiative.

courage to buy and patience to hold them is important in life as well as share market👍🏼

Hi Vivek,

Where do we start and end the threshold of patience., and how does it help to get to success.

The above looks good on paper,but what is the % of failure ?

Excellent article. From your neat explanation, I could understand clearly the term MOAT and its importance for sustainable business as well as its growth. You have highlighted ‘PATIENCE’ as one of the key attributes for a successful INVESTOR.

Thank you.

Wonderful article Got great idea about moat and business strategies

Good article.

Focusing on long run-way of business unaffected by disruption or ones which can evolve and having long term view is extremely important. Identify them earlier, courage to buy and patience to hold them will create wealth..Excellent sir

identifying moat is so relevant , earning power of the stock inspite of falling numbers clubbed with patience. Excellent read