Vivek Mashrani – India's Leading TechnoFunda Investing Specialist

Like we discussed analogy of Bamboo in my previous article of Bamboo Investing, here is the analogy derived from different mental model in martial arts. This is from famous martial art legend – Bruce Lee.

Now, as we discussed in the article for “Quest of Investing in 100 baggers”, the best strategy is – to buy great businesses with competitive advantages below intrinsic value which offers margin of safety and hold them.

What if we want to practice this value investing concept to the extreme?

So, here comes learning from Bruce Lee (below is the video advertisement of Skoda which we should look)

In this video, Bruce Lee is waiting for right opportunity to attack the opponent and when that opportunity comes, he hits a knockout punch.

Can we apply this to investing? Why not?

“Experience tends to confirm a long-held notion that being prepared, on a few occasions in a lifetime, to act promptly in scale, in doing some simple and logical thing, will often dramatically improve the financial results of that lifetime. A few major opportunities, clearly recognizable as such, will usually come to one who continuously searches and waits, with a curious mind that loves diagnosis involving multiple variables. And then all that is required is a willingness to bet heavily when the odds are extremely favorable, using resources available as a result of prudence and patience in the past.”

– Charlie Munger

Now, here is the dialogue from movie MS DHONI – The Untold Story. The background is that Dhoni is very depressed and his coach gives him life lessons from cricket.

Again, the lessons from cricket are that when we see bouncer and swing balls, we defend or skip it without taking any risky shots.

When we get full toss or loose balls then we take advantage of it and hit a six.

So true for investing as well…!!

So the learning from above are:

- Keep evaluating the businesses and wait until you find a no-brainer

- Take action only when there is high margin of safety

- When we take action, allocate with full weight of capital

Mohnish Pabrai in his lecture at University of California talks about similar concept called: Few Bets. Big Bets. Infrequent Bets.

Do watch his insightful video below. In his example he mentions that Warren Buffett and Charlie Munger invested in only 5 companies during 20 years!!

If we dissect the above strategy, there are very beautiful value investing concepts that emerge and tie-up for making one successful in investing.

High margin of safety and much more favourable odds

As a value investor, we know that investing is all about increasing odds in our favour. There is no way one can eliminate risk but by buying something way below intrinsic value we can ensure high margin of safety and odds of drastic loss decreases significantly.

Anurag Sharma explains this concept in “Book of Value” as below:

“Make no mistake: both gambling and investing are about making decisions now for outcomes in the unknown future. As such, they both require making assessments about the odds; understanding the underlying math is essential in either case. The difference is that where gamblers usually seek low odds with a high payoff , investors are inclined to seek out much more favorable odds for reasonably good returns (say, 9–1 odds for a 15 percent return with much upside potential). Marginally favorable odds (say, 51–49) would induce eager action from gamblers but none from investors.”

So, when we wait for the right pitch to swing when the buying price is much below intrinsic value we essentially get extremely favorable odds for good returns essentially almost eliminating chances of loosing money (remember most important principle of Warren Buffett – Never loose money!!).

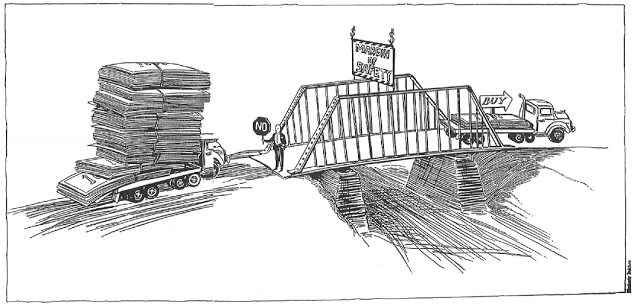

Also, it gives high margin of safety. It is beautifully explained in the newsletter “The Superinvestors of Graham and Doddsville” by giving example of truck going on a bridge.

You don’t try to buy businesses worth $83 million for $80 million. You leave yourself an enormous margin. When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it. And that same principle works in investing.”

Remember, here we are not timing the markets (which is impossible to do). We are simply waiting for the right opportunity (whenever it comes) to ensure sound investment with margin of safety and high allocation of capital in selected opportunities.

Again, as the quality of business is better there can be some compromise in terms of lower margin of safety since great businesses in itself provide margin of safety to an extent.

How to practice this principle?

There could be several ways to execute the above principle but there are few common things which are required:

- Operate within the circle of competence and keep expanding it by learning new sectors, businesses and geographies

- Always have cash which could be deployed at right time – Think cash as optionality

- Understanding of no-brainer valuation of the company where there is high margin of safety and be ready to act

Remember that individual investors have very good advantage of doing this. Mutual funds and other institutional investors have constant pressure to deploy funds and clear mandate agreed in advance.

This also implies that one need not rely on income from equity as their primary source of income. At least during the initial period of their investing.

Does such situations arise in efficient markets?

Although broadly markets are said to be efficient, there are swings in the overall market when market participants are in Euphoria and in Depression. It is very well proved in several books that prices fluctuate above and below intrinsic values and sometimes it happens to much more extreme levels.

Also, there are always pockets of sectors/companies in bear phase and bull phase within the broad market. There are several ways to spot such no-brainer situations.

Professor Sanjay Bakshi had written detailed article to look at company from different viewpoints and then determine if company is worth buying – “Vantage Point”. In this example he shows how VST Industries was no-brainer at one point of time.

Similarly, he explains how company like Piramal Enterprises was trading below cash when it sold it’s business in his article – “The Grand Strategy of Ajay Piramal” Some of the examples which I have seen recently:

- Enterprise value of Cairn India and MOIL fell below net cash on books during the commodity downturn

- During the event of demonetization in 2016, several real estate companies were having valuations much below the inventory they were holding (Mohnish Pabrai actually explained this in detail and executed on opportunity – see video “Alpha Moguls”)

- There were several special situations like buyback and delisting where with minimal risk retail investors could have allocated capital for good returns (Example: Buybacks like HCL Tech, MPhasis, Infosys, TCS etc. gave 50%+ annualized returns without much risk last year)

Technical tools like supports and resistances, trend-lines, RSI oversold zones further helps in validating above situations and helps ride with other smart investors who act at such levels.

Obviously, one must access the promoter quality and corporate governance of the companies and decide margin of safety and in some case need to give a miss also. But as the concept says – we need not act on all the opportunities which come to us. Only few powerful decisions are sufficient.

Psychological factors

Is it easy to put this into practice? – The fight within

As I mentioned in the article “Quest for investing in 100 Baggers” – Boredom Arbitrage

Investors crave activity and stock markets are built on it. The media feeds it all, making it seem as if important things happen every day. This results in churning of portfolio in very short time period.

The ecosystem doesn’t want you to sit tight, they want to charge you fees, brokerage and sell you stuff. The greatest fortunes however come from gritting your teeth and holding on.

Seth Klarman in his book “Margin of Safety” aptly mentions:

“The greatest challenge is maintaining the requisite patience and discipline to buy only when prices are attractive and to sell when they are not, avoiding the short-term performance frenzy that engulfs most market participants.”

This implies that it is very good if one has some other activity/hobby like reading books, music, sports, etc where one can find ways to avoid such boredom.

Frustrating times

There might be cases when one continuously examines several opportunities for long period of time but end up with no good position. That should be perfectly fine but very frustrating at times. One more quote from “Margin of Safety”:

“Sometimes a value investor will review in depth a great many potential investments without finding a single one that is sufficiently attractive. Such persistence is necessary, however, since value is often well hidden. The disciplined pursuit of bargains makes value investing very much a risk-averse approach.”

Ability to Endure Pain

Although one buys way below intrinsic value with extreme margin of safety, there is no guarantee that price will not go further down. Market could be irrational for a long period of time and swings could be very extreme.

After investing with conviction and high margin of safety, one needs to have ability to endure pain when prices go further down and stays there for long period of time. There is very good lesson from movie Sultan which one can follow here.

Conclusion:

Investors need discipline to avoid the many unattractive pitches that are thrown, patience to wait for the right pitch, and judgment to know when it is time to swing and conviction as well as courage to swing it with full force (capital)…!! Just like Bruce Lee…!!

Disclaimer: All stocks quoted are just for example, these are not buy/sell recommendations.