Vivek Mashrani – India's Leading TechnoFunda Investing Specialist

Start Your Stock Market Journey

Know More About me

I am on a mission to help 100,000 retail investors to achieve financial freedom using TechnoFunda Investing process…

This website is created to empower retail investors with time tested knowledge resources of Technical and Fundamental analysis.

I believe that process is more important than outcome.

I have developed TechnoFunda investing process which will help you achieve financial freedom through wealth creation.

And for that I would like to share a little about myself…

My Background

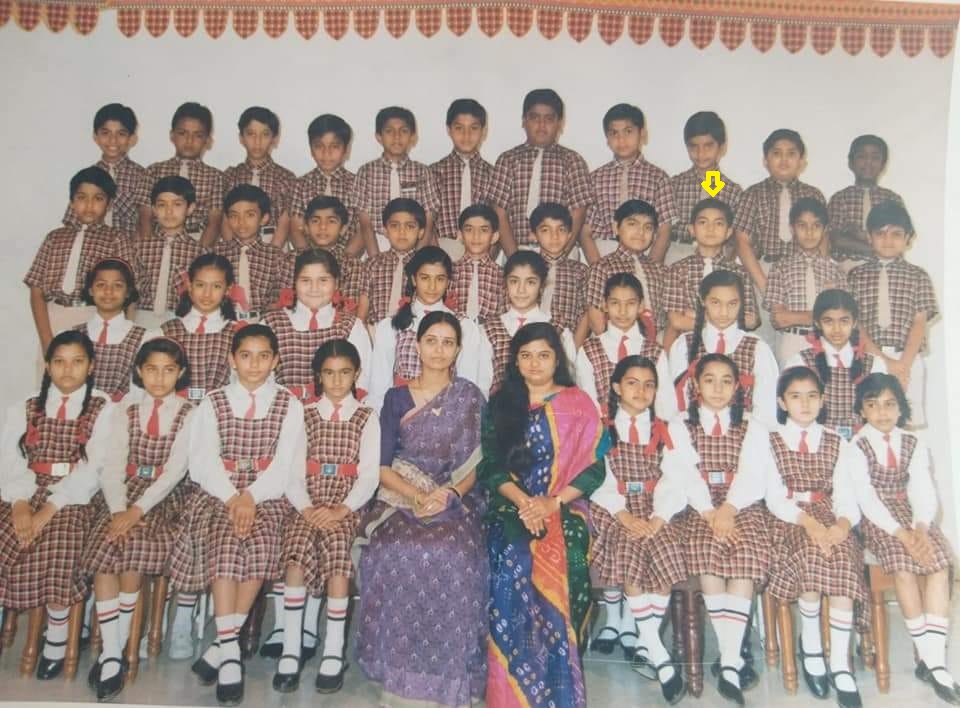

It was the year 1997. I was in 5th standard. That’s me in my class picture.

I got my result. I was bright student. But this year…there was a disappointment.

My marks were good in all the subjects, except one – the newly introduced subject “drawing”, and I could not get in top 3.

I showed my result to my father. I got 36 marks in drawing. I was basically grace pass. Just 1 mark above passing marks.

He said “It’s alright beta…you can learn it and score better in future”.

I probably did not understand the context fully that time but somehow it got ingrained in me. And now when I look back to my journey, I have been following his guidance since then.

The biggest lesson he gave me – never to get disappointed by failures, keep learning and bounce back.

I actually topped drawing subject in class 7 with 90 marks when it was last year for this subject. But the lesson remained with me.

The Search Within…

After completing my 12th, joined Mechanical Engineering in government college in Morbi, a small town in Gujarat.

I fell in love with the place on day 1.

I could see river from my college class and my hostel building. I got amazing friends here.

Although I liked the course, I could not relate myself with Mechanical Engineering Career.

I got offer letter for Infosys in my 3rd year and that when I got introduced to markets in 2007.

Quest towards stock markets

I continued my trading during market hours and work during office hours (thanks to flexi timing).

Slowly learnt bit about F&O.

Slowly got into leveraged trades – so called “Margin PLUS” which gives 20x exposure on your margin money.

I just kept trading despite frequent losses and very few wins. Many times, my salary used to get wiped-off on same day it got credited.

Market started crashing in mid-2008. I shorted few stocks and made money. I thought I learnt trading, finally.

The Big Mistake

I was October 2008. I thought market has bottomed. Decided to go long with heavy leverage.

And BOOM…!!

My broker started calling me. I was upset.

I could not take my food properly. I didn’t know what to do.

Unbelievable – I blew my account.

Market crashed badly during the month and along with this all my savings went down the drain.

I was BROKE.

Only saviour was my ongoing salary. So, I decided to stop trading and do some serious investing.

I understood the hard way what disaster can combination of derivatives and leverage bring in.

Early days in Investing

Then I tried short term investing. It gave quick money in 2009 as it was post 2008 housing crisis bottom.

Bought stocks like Karuturi Global (leader in flower exports), Suzlon (leader in wind business), Opto Circuits (medical equipment technology company), Koutons Retail (leading retail chain) etc.

But soon realized that I am making losses even in investing. I sensed that something is still wrong.

This is when I decided to learn seriously about investing.

Fortunately, I got an offer letter to join NMIMS, Mumbai in their MBA Capital Markets course.

This course was designed in collaboration with BSE for students who wanted to learn about stock markets.

I resigned from Infosys and decided to join this course.

Didn’t have much in savings. Hence, I decided to take education loan and later repay myself.

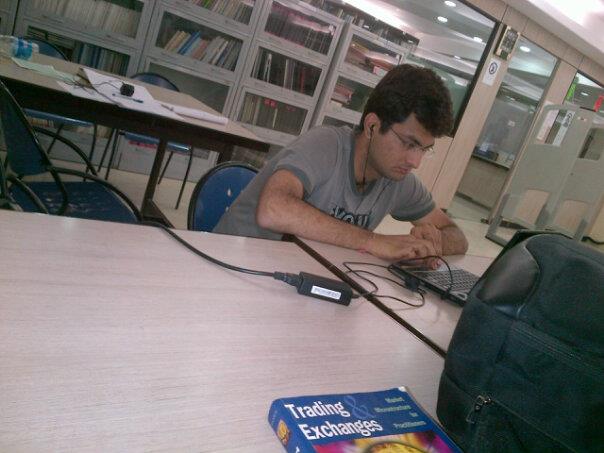

2 years of transformation

I joined NMIMS, Mumbai.

Fell in love with my classroom which had posters of stock market all around. We had a mock TRADING ROOM too.

Although most students came there for degree and job, my motive was just LEARNING.

Was fortunate to have practicing faculties from industry come there for teaching.

I learnt about various subjects like accounting, fixed income, fundamental analysis, technical analysis, SEBI laws etc.

Alongside cracked CFA level 1 and level 2 exams.

And the transformation started…

I could now clearly understand my mistakes that I made in past.

This is when I understood power of blending fundamental analysis and technical analysis. Started my own research.

The journey of TechnoFunda investing.

Kept being better at my process, year on year, and started achieving results.

The TechnoFunda Investor Unleashed

Simultaneously, started career in Investment banking after college. And also kept improving on investing.

Repaid my loans within 2 years.

Kept learning from my mistakes and kept improving my TechnoFunda Investing process.

Met many successful traders and investors. Particularly, ValuePickr community helped me a lot.

Was fortunate to interact at length about investing journey, mistakes and success stories of many of these investors and incorporate them in my investing style in best possible way. It had truly been a great experience.

Financial Freedom Journey

When I look back at my journey, I had to face many hurdles due to lack of finances and compromise to an extent. Also, I was fortunate to learn from my mistakes early in my investing journey.

Achieved first level of financial freedom where my passive income from investing and other sources cover operating expenses related to essential needs.

My Big Vision

I am on a mission to help 100,000 retail investors to achieve financial freedom using TechnoFunda Investing process…

And I am glad that you are here.

I would love to help you achieve your goals towards financial freedom.

If you are able to resonate with my journey, then let’s stay connected.

I would like you to start this journey and achieve financial freedom while continuing to work on what you like to do.

All the best.

To your financial freedom,

Vivek Mashrani, CFA

Want to start your journey towards financial freedom?

I am on a mission to help 100,000 retail investors to achieve financial freedom using TechnoFunda Investing process…